credit and debit

The Invisible Force Behind the Economy

Welcome to the first article in our series on the Big Debt Cycle.

These four articles will explore how individuals, countries, and financial institutions navigate the complex economic web behind major debt cycles. To better understand this topic, here are some of the key questions we aim to answer:

- What are Credit and Debt?

- What is a Debt Cycle? How does it develop? Why is it so important?

- How do Debt Crises emerge?

- How should policymakers and central bankers act to avoid financial catastrophe?

- How can we prevent Debt Crises?

These are just a few of the questions we will address. But for now, let’s start with the basics: What exactly are credit and debt, and why are they so important?

Let’s begin with a simple definition:

- Credit is the allocation of purchasing power from one entity to another.

- Debt is the amount that has been promised to be repaid to the lender.

The importance of one explains the importance of the other—they are two sides of the same coin. To better understand them, imagine the economy as a ball of yarn, where every thread is a transaction between two or more people.

A person’s salary is made possible because someone else is spending; similarly, one person’s debt exists because another holds a claim—a credit—against it.

See why it matters?

The ability to make purchases through access to credit is a foundational element of a stable and growing economy. Both too little and too much debt growth can be problematic.

In an economy where debt is ‘too expensive’ (i.e., interest rates are too high for even modest borrowers to afford interest payments), growth becomes difficult. This means that the cost of borrowing is so high that it hinders economic growth. Individuals and businesses who would otherwise borrow to invest in the future or start a venture can no longer do so on acceptable terms.

But what exactly is the problem with debt?

The most significant issue is that debt is often not used to generate returns sufficient to repay it. In other words, borrowed money is spent on activities that are not productive enough (in terms of income flow) to cover the cost of the debt itself. For instance, using a loan to start a business that generates profits is a productive use of debt, while using a loan to fund a lavish vacation is a non-productive use of debt.

The problem, therefore, is not debt in itself—but misusing it. Misuse of debt can take many forms, such as borrowing more than one can afford to repay, or using debt to fund non-essential or non-productive activities.

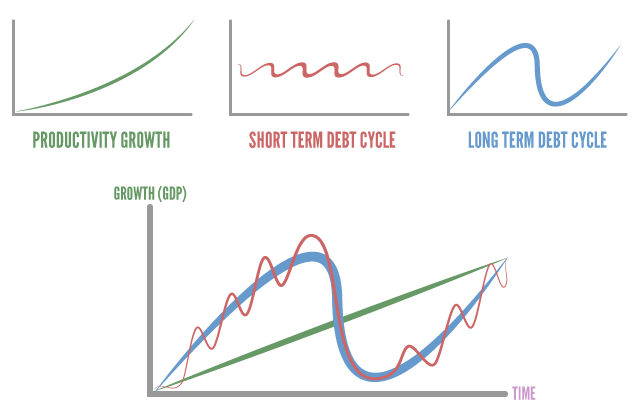

Now that we (hopefully) understand what credit and debt are, we can move on to the formation of cycles. At the heart of these cycles lies human psychology—and the unfortunate reality that has led the world into some of the most devastating crises: people often spend more than they can afford.

In the next article, we will delve deeper into how debt crises are born. In times like these, it’s crucial to understand how governments and central banks manage the extraordinary levels of public debt accumulated over the years. More importantly, we’ll explore the measures in place to prevent potential financial catastrophes.

Understanding credit and debt is a key to navigating the complex economic web.

We look forward to exploring this topic further in the next article.

See you there!

Leave a Reply