The Corporate Report Option Strategy

Trade with an edge while managing risk

Author: Paolo Gatto

an overview

In the dynamic landscape of options trading, a well-defined strategy is paramount for navigating market complexities and optimizing returns. The Corporate Report Option Strategy is a meticulously developed approach, primarily focused on premium selling, designed to leverage statistical edges and active management for enhanced profitability. The strategy was built after months of analytical studies of the best traders in the market. The biggest inspiration was given by the TastyTrade team, which everyday teaches on Youtube and other platforms how to trade options and build an hedge in the market. I suggest that anyone interested in options (after reading this article!) check out their lessons on their YouTube channel, they taught me most of what I know about options.

This article delves into the core tenets of this strategy, providing an overview of its various components, from underlying selection to sophisticated risk management techniques.

1. Choosing the Underlying Asset

The foundation of any robust options strategy lies in the careful selection of the underlying asset. For The Corporate Report Option Strategy, the following criteria are critical:

- High Liquidity: Prioritizing highly liquid assets ensures efficient entry and exit points, minimizing slippage and facilitating seamless trade execution.

- Tight Bid/Ask Spread: A narrow bid-ask spread is indicative of a liquid market, allowing for better pricing and reduced transaction costs, which is crucial for premium sellers.

- High Implied Volatility (IV): The strategy actively seeks underlyings with high implied volatility. The objective is to profit from the subsequent contraction of IV, a common phenomenon where options premiums decrease as volatility reverts to its mean.

- High Open Interest and Volume: Significant open interest and trading volume are indicators of robust market participation, further contributing to liquidity and tighter spreads.

- Understanding the Product: Traders are advised to stick to products they thoroughly understand. This deep comprehension of the underlying’s fundamentals and market behavior is invaluable for informed decision-making.

- Diversified Product Universe: The strategy advocates trading a diversified portfolio of approximately 30-50 products, encompassing a mix of stocks, Exchange-Traded Funds (ETFs), and potentially futures, to spread risk and capture opportunities across various market segments.

2. Choosing Contract Duration (Days to Expiration)

The selection of the optimal contract duration is a cornerstone of this premium-selling strategy, emphasizing the exploitation of time decay.

- Optimal DTE Span: The most favorable Days to Expiration (DTE) range for opening trades is between 45 DTE and 21 DTE.

- Trade Closure at 21 DTE or 50% Profit: Trades initiated within this window should ideally be closed at 21 DTE or when they achieve at least 50% of their maximum potential profit, whichever comes first.

- 21 DTE Significance: The 21 DTE mark is particularly significant due to its balance between limited gamma exposure and a statistical edge. At this point, the rate of time decay (theta) accelerates, benefiting premium sellers, while the sensitivity to price movements (gamma) remains manageable compared to closer expirations.

3. Strategy Weight (Capital Allocation)

Prudent capital allocation is essential for managing risk and maximizing the efficiency of trading capital. The strategy distinguishes between undefined and defined risk approaches:

- Undefined Risk Strategies (e.g., Strangles, Naked Puts/Calls): A significant portion, specifically 75% or less of total liquid capital, should be allocated to undefined risk strategies. These strategies typically offer a higher Probability of Profit (POP) but inherently bear higher risk and thus demand greater capital requirements.

- Defined, Low-Medium Risk Strategies (e.g., Iron Condors, Credit Spreads): The remaining 25% or more of the capital should be deployed in defined, low-to-medium risk strategies. These strategies limit potential losses, making them suitable for complementing the higher-risk components of the portfolio.

4. The Greeks: Delta and Theta

Understanding and managing “The Greeks”, particularly Delta and Theta, is fundamental to this premium-selling framework.

- Delta Management: The Delta of chosen options should ideally range between 10 and 40 (+ bullish while – is bearish). This range provides a decent exposure to potential upside movements while maintaining moderate sensitivity to wild price swings. For traders seeking minimal directional bias, delta-neutral strategies can also be employed.

- Theta (Time Decay): As premium sellers, the strategy inherently benefits from time decay. While adhering to a precise Theta value can be challenging, traders should be acutely aware that time decay accelerates significantly as options approach expiration, contributing positively to the profitability of sold premiums.

5. Trade Management

Active trade management is a core tenet of The Corporate Report Option Strategy, aiming to enhance both average Profit and Loss (PnL) and overall Probability of Profit (POP).

- Active Approach: The strategy emphasizes an active management style. This proactive engagement with trades is believed to increase both the average PnL and the overall POP.

- Number of Positions: The number of actively managed trades concurrently depends on the account size. For accounts ranging from $5,000 to $10,000, maintaining 5-10 positions simultaneously is considered appropriate.

- Closure/Adjustment Triggers: Trades should be closed, rolled, or adjusted under two primary conditions:

- Half DTE Life: When the trade reaches half of its initial DTE (e.g., a 45 DTE trade should be managed at 21 DTE).

- Profit Target: When the trade achieves a profit between 50% and 75% of its maximum potential, especially if there are indications of a changing market sentiment.

6. Trade Management

Effective risk management is critical for the long-term sustainability of any trading strategy, particularly one involving premium selling.

- Position Sizing for Small Accounts ($5-10k): For smaller accounts, each individual position should represent a modest 4-5% of the total portfolio liquidity. This is calculated based on the Buying Power Reduction (BPR) relative to the portfolio’s liquid capital.

- Position Sizing for Medium-High Accounts (+$20k USD): For larger accounts, a more conservative position size of 1-3% per trade is recommended, allowing for a greater number of simultaneous positions (e.g., +20 positions).

- Correlation Diversification: Trading underlyings that are not highly correlated is crucial. This diversification helps the portfolio react differently to market events, mitigating concentrated risk and fostering overall stability.

7. TIps & tricks

Beyond the core principles, several practical tips and tricks can further refine the application of The Corporate Report Option Strategy:

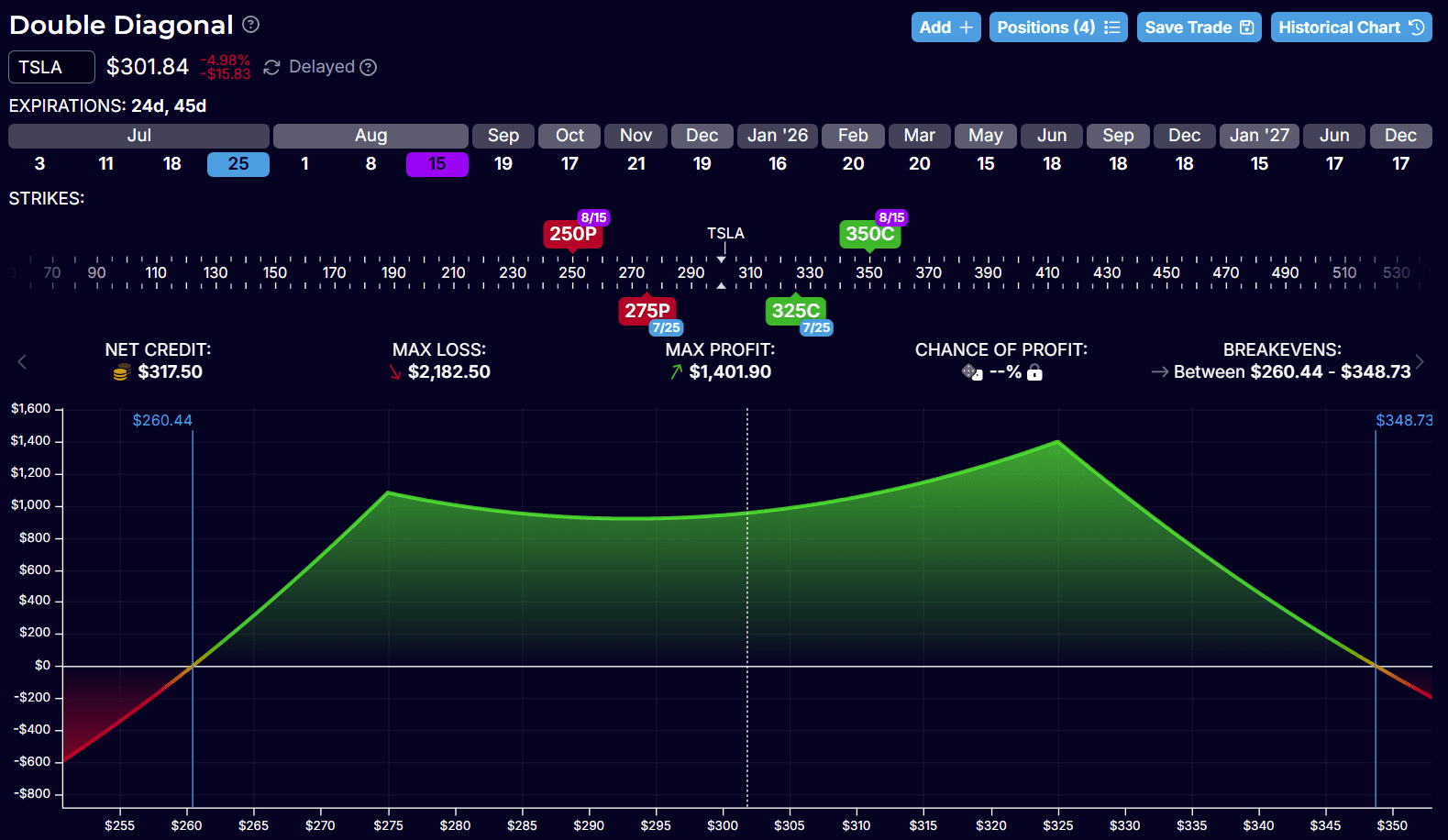

- Strategy Mix: Employ a combination of strategies to enhance portfolio diversification. For instance, pairing a strangle with a bull call spread can provide varied exposure and risk profiles.

- High IV Periods: During periods of elevated implied volatility (e.g., VIX consistently above 20-25), consider slightly increasing position sizing. This allows for greater profit capture from the anticipated IV contraction.

- Wider Wings for Increased Risk: If the objective is to increase the risk exposure of a position, it is generally preferable to use wider wings in defined risk strategies (like Iron Condors) rather than simply increasing the number of contracts traded. This approach maintains a defined risk profile while expanding potential profit.

- Loss Management: Proactive management of losses is critical. Always monitor how positions are performing and adjust them accordingly to avoid extreme losses. The ability to cut losses short is a hallmark of successful trading.

- High IV – Low Cost Underlyings (Small Accounts): For smaller accounts, focusing on high IV, low-cost underlyings (e.g., stocks priced under $100 per share) can provide accessible entry points while still offering attractive premium-selling opportunities.

- Active Engagement: Consistently remain active in managing your portfolio. This ongoing engagement allows for timely adjustments and adaptation to evolving market conditions.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial advice. Options trading involves a high degree of risk and is not suitable for all investors. You could lose a substantial amount of money. Always consult with a qualified financial professional before making any investment decisions.

Leave a Reply